FHA loansįHA loans are a favorite with first-time homebuyers because you can often qualify with a credit score as low as 580, and down payments can be as little as 3.5%. The minimum credit score for a Quicken Loans conventional mortgage is 620. However, lenders usually require homebuyers making down payments of less than 20% to take out private mortgage insurance. Quicken Loans may approve borrowers with good credit to buy a home with a down payment of as little as 3%. Instead, it’s guaranteed by a private lender. Conventional mortgagesĪ conventional mortgage is a loan that isn’t insured by a government agency such as the FHA, VA, and USDA.

Quicken Loans offers a broad range of purchase mortgages, including conventional, jumbo, FHA, VA, and ARM loans.

Quicken loans fha how to#

Learn More: How to Get the Best Mortgage Rates Quicken Loans vs. You’ll meet virtually with the lender and notary via web conference and sign all closing documents online.

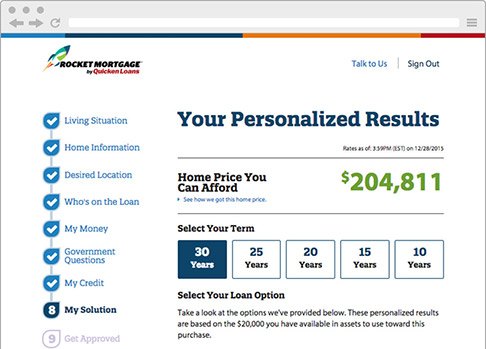

You can apply for a home loan by calling Quicken and speaking directly with a home loan expert, or complete the process online using Rocket Mortgage. Quicken Loans services 99% of the home loans it originates, so you work with the same company from application to closing and beyond. Quicken Loans mortgage refinancing review.Read through this review to find out more about what Quicken Loans, one of our vetted partner lenders, offers and how you can compare rates from multiple mortgage lenders to find the right fit for you. With the Quicken Mortgage YOURgage loan, you can even customize the repayment term on your fixed-rate loan by choosing any loan length from eight to 29 years. When you apply for a mortgage from Quicken Loans, you can work out the details over the phone or complete the entire process online using Rocket Mortgage, Quicken Loans’ digital mortgage platform. Quicken Loans is the nation’s largest mortgage lender even though it doesn’t operate any branch offices. NMLS # 1681276, is referred to here as "Credible." Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Our goal is to give you the tools and confidence you need to improve your finances.

0 kommentar(er)

0 kommentar(er)